With financial planning checklist at the forefront, get ready to dive into a world of smart money moves and strategic planning. This checklist is your roadmap to financial stability and success, so buckle up for a ride filled with tips, tricks, and expert advice.

Importance of a Financial Planning Checklist

Having a financial planning checklist is crucial for individuals as it serves as a roadmap to achieving their financial goals. It helps in staying organized, tracking progress, and ensuring that all aspects of financial planning are considered.

Benefits of Using a Checklist in Financial Planning

- Provides a clear overview: A checklist helps individuals see the big picture of their financial situation, including income, expenses, savings, and investments.

- Ensures nothing is overlooked: By following a checklist, individuals can ensure that all important financial tasks are completed, from setting a budget to saving for retirement.

- Helps prioritize goals: With a checklist, individuals can prioritize their financial goals based on importance and urgency, making it easier to focus on what matters most.

How a Checklist Can Help in Organizing and Prioritizing Financial Goals

- Setting clear objectives: A checklist allows individuals to clearly define their financial goals, whether it’s buying a house, paying off debt, or saving for education.

- Breaking down tasks: By breaking down larger financial goals into smaller, manageable tasks on a checklist, individuals can make progress towards achieving them more effectively.

- Tracking progress: Regularly updating and reviewing a financial planning checklist helps individuals track their progress, make adjustments, and stay on course towards achieving their goals.

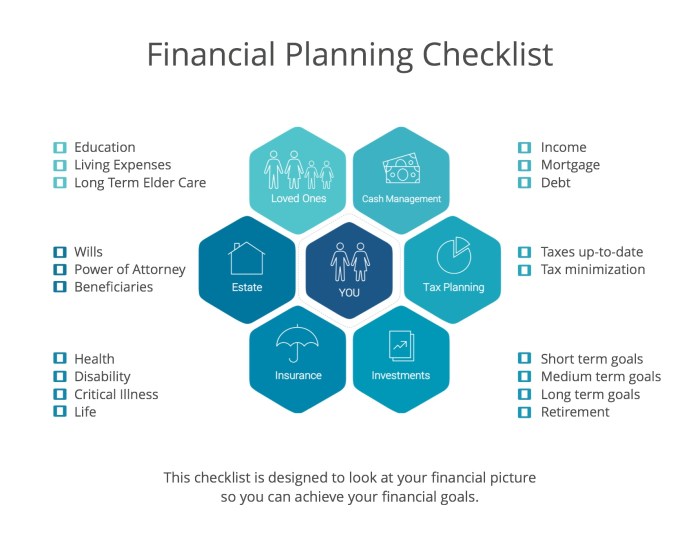

Components of a Comprehensive Financial Planning Checklist

When creating a financial planning checklist, it is essential to include key components that cover various aspects of your financial well-being. These components help you stay organized, focused, and prepared for the future.Budgeting, Savings, Investments, and Retirement Planning:Including budgeting in your checklist allows you to track your income and expenses, ensuring you are living within your means. Savings is crucial for building an emergency fund and achieving financial goals.

Investments help grow your wealth over time, while retirement planning ensures you have enough funds to support yourself during your golden years.

Insurance

Insurance is a vital component of financial planning as it protects you and your assets from unforeseen events. This includes health insurance, life insurance, disability insurance, and property insurance. Having the right insurance coverage can provide peace of mind and financial security for you and your loved ones.

Taxes

Taxes play a significant role in your overall financial plan. It is essential to understand how taxes impact your income, investments, and retirement savings. By including tax planning in your checklist, you can optimize your tax strategy and minimize your tax liability, ultimately maximizing your wealth.

Estate Planning

Estate planning involves preparing for the distribution of your assets and wealth after your passing. This includes creating a will, establishing trusts, assigning beneficiaries, and minimizing estate taxes. By including estate planning in your checklist, you can ensure that your loved ones are taken care of and your assets are distributed according to your wishes.

Creating a Personalized Financial Planning Checklist

Creating a personalized financial planning checklist is essential to ensure that your financial goals are aligned with your current situation and future aspirations. By tailoring the checklist to your individual needs, you can better track your progress and make informed decisions to achieve financial success.

Steps to Create a Personalized Financial Planning Checklist

- Assess Your Current Financial Situation: Take stock of your income, expenses, assets, and debts to understand where you stand financially.

- Define Your Financial Goals: Identify short-term and long-term goals, such as saving for retirement, buying a house, or starting a business.

- Understand Your Risk Tolerance: Determine how much risk you are willing to take with your investments based on your comfort level and financial goals.

- Create a Budget: Develop a budget that aligns with your goals and helps you allocate funds towards savings and investments.

- Select Appropriate Investments: Choose investment options that match your risk tolerance, time horizon, and financial objectives.

- Monitor Your Progress: Regularly review your checklist to track your financial journey and make adjustments as needed.

Tips for Tailoring the Checklist to Individual Financial Goals

- Customize Your Goals: Tailor your checklist to reflect your unique financial goals and priorities, whether it’s saving for a dream vacation or building an emergency fund.

- Include Specific Action Items: Break down your goals into actionable steps with deadlines to keep yourself accountable and motivated.

- Consider Life Changes: Update your checklist to reflect any major life events or changes in your financial situation, such as getting married, having children, or changing jobs.

Importance of Regularly Reviewing and Updating the Checklist

- Adapt to Changing Circumstances: Regularly reviewing and updating your checklist allows you to adapt to changes in your financial situation and stay on track towards your goals.

- Identify Areas for Improvement: By revisiting your checklist, you can identify areas where you may need to adjust your strategies or reallocate resources to optimize your financial plan.

- Maintain Financial Discipline: Consistent review and updates help you stay disciplined in managing your finances and making informed decisions to secure your financial future.

Using Technology for Financial Planning Checklists

Technology has revolutionized the way we manage our finances, and utilizing various tools and apps can greatly enhance the effectiveness of financial planning checklists. By incorporating digital platforms, individuals can streamline the process, access real-time updates, and ensure better organization of their financial goals and tasks.

Tools and Apps for Financial Planning Checklists

- Personal Finance Software: Programs like Mint, Quicken, or YNAB offer comprehensive features for budgeting, tracking expenses, and setting financial goals.

- Mobile Apps: Apps like PocketGuard, Wally, or EveryDollar provide on-the-go access to budgeting tools, expense tracking, and goal setting.

- Online Tools: Platforms such as Personal Capital or Betterment offer investment tracking, retirement planning, and portfolio management services.

Benefits of Digital Platforms vs. Pen-and-Paper Checklists

- Real-Time Updates: Digital platforms allow for instant updates and syncing across devices, ensuring the most current information is always available.

- Automation: Many apps offer automation features for bill payments, savings transfers, and investment monitoring, saving time and reducing manual errors.

- Integration: Digital tools can integrate with bank accounts, credit cards, and investment accounts, providing a holistic view of one’s financial situation.

Recommendations for Financial Planning Software, Financial planning checklist

- Mint: A popular choice for budgeting, expense tracking, and goal setting, with easy-to-use interfaces and customizable features.

- Personal Capital: Ideal for investment tracking, retirement planning, and net worth analysis, offering tools for long-term financial planning.

- YNAB (You Need A Budget): Focuses on zero-based budgeting, helping users allocate every dollar towards specific categories and financial goals.